#2 Jack's Weekly Digest - Europe's Gatsby-esque VC, living spaceships and meta-science

This week's reads include: "my name's Ian, Ian Osborne", plugging yourself in the experience machine, building living spaceships, what the mRNA vaccines teach us about meta-science, and much more.

Welcome back. Here's the #2 issue of Weekly Digest

Here's a reminder of what this newsletter consists:

- Weekly issue delivered to your mailbox every Sunday

- 10 Reads of the Week

- My analyses and suggestions for further readings

- Jokes of the Week

- (if any) Links to my new blog posts

This week's reads include "my name's Ian, Ian Osborne", plugging yourself in the experience machine, building living spaceships, and what the mRNA vaccines teach us about meta-science.

Let's get started!

10 Reads of the Week

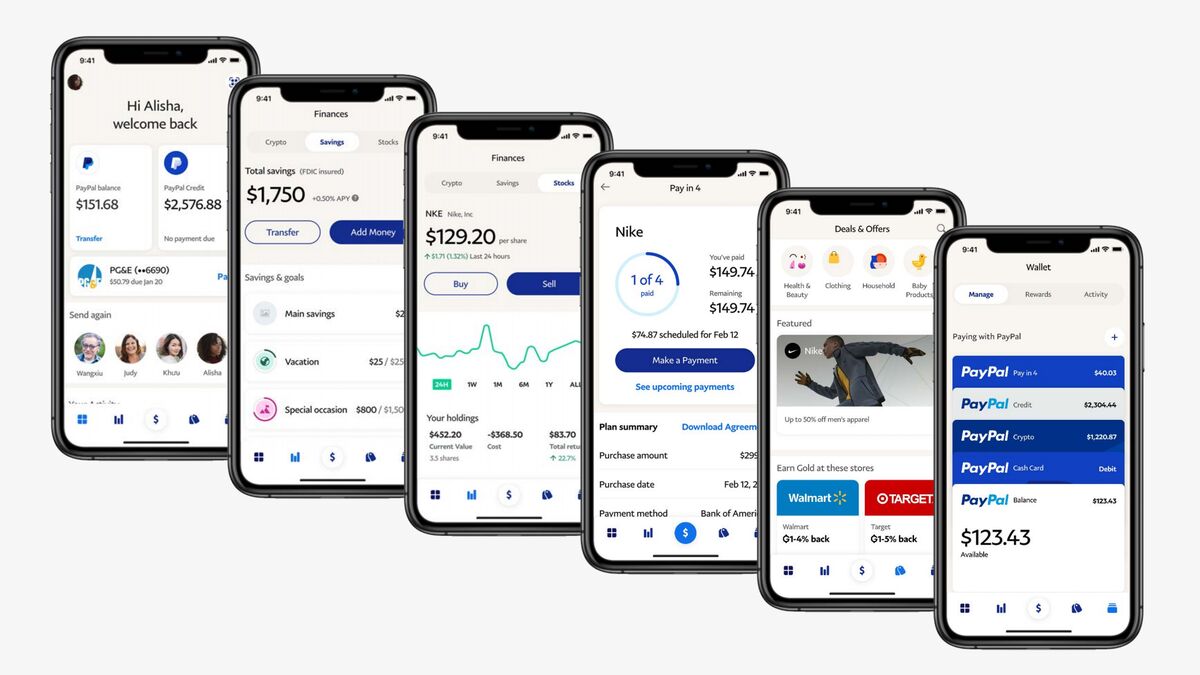

1. Paypal, sort out your shit customer service first

Paypal serves as a case study for the Innovators' Dilemma. In other words, Paypal got lazy. Square and Monzo got busy and hustled hard.

Paypal also had its fair share of history and legacy that rather outshrines its core competency.

The PayPal Mafia has contributed $1.3 trillion of startup value.

— Chris Hladczuk (@chrishlad) May 10, 2021

Founders or investors in these companies:

• Uber

• Tesla

• Stripe

• Square

• Palantir

• SpaceX

• YouTube

• Pinterest pic.twitter.com/dd7owOspU9

The Paypal Mafia is Sauron's All Seeing Eyes, ruling over its Mordor (the Silicon Valley) with secrecy (Peter Thiel), money (Hoffman's blitzscaling) and insanity (Elon Musk and his army to the moon).

And one indicator of whether or not an innovative institution persists is to look at its talent retention. After Paypal's acquisition by eBay in 2002, most of its core team left. I take it as that Paypal had lost its appeal even to the co-founders and the insiders of the Mafia.

The motivation of discussing Paypal stemmed from my recent experience with it. Its user experience is completely shit. And its customer service/support is also completely shit.

For context: my Paypal account is based in Hong Kong, but I have recently moved to Oxford, the United Kingdom. I received a donation lately and wanted to check the transaction.

In order to log in, I was required to complete a two-factor authentication. Fine. An extra layer of security does not hurt. The problem is that only SMS authenthciation was available. But I am no longer in Hong Kong! And there are no ways to log in via alternative methods. I looked up on the 'Contact Us' page. What you get is this:

I want customer service to help me log in. And you are telling me that I need to log in first?

Surely Paypal can afford a chatbot customer service. It's 2021, boomers. No one calls or sends emails (okay, sometimes) to get things sorted.

And this is just my first complaint. On top of shit customer service, Paypal is also surprisingly anti-global. I called the UK office and they could not help with my case because my account is based in Hong Kong.

Paypal, are you really worth $300B+?

Going back to the Bloomberg article, so Paypal wants to be the Wechat Pay of the West. It wants to do savings, check-cashing and even investing.

Paypal might be great at B2B payments and banking solutions. But B2C consumer fintech? You might win the boomers. But you will not win Monzo, Revolut, Chime, and Square Gen-Z users.

2. My name's Ian, Ian Osborne.

Ian Osborne, a 38-year-old British venture capitalist, recently hit the Financial Times headline with an investigative profile on him.

His firm, Hedosophia, has made 'covert' investments in Spotify, TransferWise, Ant Financial, N26 etc. They are 'covert' is beacuse Hedosophia's name is nowhere to be found in fundraising public press releases. This is extremely rare in the VC world where clout begets cash, cash begets success, and success begets more clout. Even more rare for a $1.5bn venture capital fund that counts its Limited Partners (LPs) with funds from Michael Bloomberg, Hong Kong tycoon Li Ka-shing and the Burda family of Germany.

Osborne himself is also nowhere to be found online. Extremely rare as a venture capitalist, he has scarce digital footprint. He recently partnered with Chamath to raise an European SPAC, raising as much as $500M listing in Amsterdam. Interviewed by FT, his associates described him as 'a real man of mystery'.

And his professional history is even more impressive, if not mysterious. He graduated from London School of Economics (LSE) in 2005, becoming a 'Conservative Party adviser' in 2009, advising Michael Bloomberg as a client in 2010, and starting Osborne & Partners (O&P), a strategic and reputational advisory firm. Sifted.eu described it as something of a “fixer-slash-PR” company for high-net-worth individuals in tech, politics and business.

Founder of Spotify, Daniel Ek, also spoke highly of Osborne:

“At first it was like, ‘what is this British 20-something doing in the midst of US politics?’ It didn’t make much sense,” said Daniel Ek, founder of Spotify, who met Osborne in this period. Initially, Osborne offered “advice, connections with people”, according to Ek. “But his Rolodex was off the charts for someone so young. The connection between politics and business today seems like an obvious fit but at the time no one was making the link.”

By 2013, he hosted a lavish party in Davos alongside billionaire entrepreneur Sean Parker (he was in the movie Social Network!) and Salesforce.com CEO Mark Benioff.

The story of Ian Osborne's rise is particularly interesting for me because we are similar in some respects: he splits his time between Hong Kong and London; he is still very early in his career (mid-30s); he is in venture capital.

The media must have missed many nuances of Osborne's story. Expect a piece on Lunch with FT or Vanity Fair or Institutional Investor in the next few years. We need an account on how he has played the meta-game well and chosen his game carefully

If I get to meet him, I would tell him, 'Ian, we both made it to the Financial Times except I don't run a billion-dollar fund. Wanna help me?'.

But then again, maybe the media deliberately missed the nuances?

3. the SPAC bubble is going to be SPACtcular!

I have conflicting feelings for Chamath. On the one hand, he called out the bullshit in unnecessary VC hype. On the other hand, he himself hyped up $GME, crypto and his own SPACs from $IPOA to $IPOZ. He is the Janus of capital markets.

My takeaway from Bloomberg's profile on him is that alaways be at the right place at the right time. He join Facebook in 2007 and left in 2011, starting his own VC, Social Capital. He rode on the wave of 1) social media 2) VC and now, he made the wave of 3) SPACs.

Good journalists present findings. Pulitzer-worthy journalists create narratives. The ending of Bloomberg's piece hints at Chamath's hamartia, his tragic flaw. Ultimately, what he is good at – market mania – might lead to his own demise.

Wait til the bear market comes. We are already half-way in the crypto winter.

* insert winter is coming GOT meme *

4. How to monetise your time

Play-to-earn is not original at all. The entire concept of e-sports revolves around the demand and supply of in-game virtual assets. And these assets are the foundations of the second-order market for the labour power of gamers. 2000s was the golden age for MMORPG in-game asset trading, especially in World of Warcraft and Diablo.

What I found striking, learning from the video, is that:

Fact 1

The average income from playing the game (Axie Infinity) is $300/month, double that of the minimum wage in the Philippines at $170/month

Second-order implications from Fact 1

- Games and speculators group together and form 'companies'. The closest comparable might be an e-sports studio that trains and 'owns' the players. For Axie Infinity, these studios pool their assets and risks. They scale up their operations by going into Income-Sharing Agreements with new games who do not have enough upfront capital.

- The form of organisation is, rather unsuprisingly given 2021, Decentralized Autonomous Organisation (DAO).

Rex Woodbury from Index Ventures further investigated this phenomenon. He even raised an example of how early crypto adopters tokenized their time, allowing investors to invest in themselves as 'assets'.

Should I issue a $JACK token? Will you buy? Strong HODL please.....

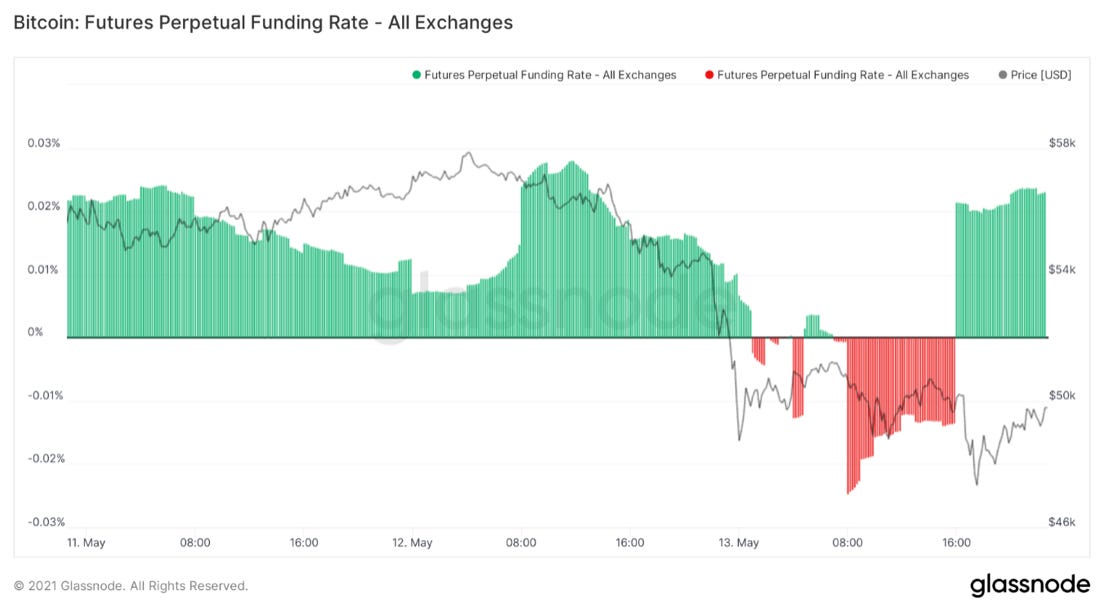

5. Insiders trade tweets ; Outsiders trade $BTC

Pomp's substack is known to be the leading indicator of crypto market sentiment. Admirably he has gathered an impressive collection of statisitics that seems to suggest some insider trading activities with the recent dump of Bitcoin.

My takeaway: someone had insider information to sell $BTC right before Elon's tweet about Tesla not accepting BTC as payment method.

6. If you can't tell the difference, does it matter?

Rex's Digital Native strikes again. He started off stating the Proteus Effect, the 'phenomenon that our behaviors within virtual worlds are influenced by the characteristics of our avatar'.

This is Miko. She's a virtual streamer who is controlled by a real-life woman known only as The Technician.

— Rex Woodbury (@rex_woodbury) April 30, 2021

The Technician uses the Unreal Engine and a $30,000 motion-capture suit to create Miko.

Thread 👇 pic.twitter.com/EtLrvdoRy2

This streamer on Twitch uses a synthetic avater to substitute her 'real self'. Miko is now the first and the largest Twitch streamer in the virtual streamer space.

What is the implication of all this? Rex is optimistic. He thinks that 'interacting through avatars and virtual worlds will unlock a new era of self-expression and facilitate new forms of digital relationships.'. On the contrary, I am rather pessimistic.

As our computational power exponentially increases, we can gradually simulate reality. The future of Ready Player One is certainly alarming. Equally, philosopher Robert Nozick's Experience Machine reminds us that as much pleasure the virtual world gives us, we feel that there is still something missing.....

Interested in the implications of Virtual Reality/Augmented Reality (VR/AR) technology? Check out Aaron Frank's work at the Singularity University. We recently met as he is now doing a MBA at Oxford's Said Business School. I absolutely enjoyed our chat about the second-order implications of expotential technology.

If you prefer something lighter, watch Westworld. To be honest, Westworld is quite 'heavy' as well.

7. The future of bio-machinery

/https%3A%2F%2Fspecials-images.forbesimg.com%2Fimageserve%2F5d69695968cb0a0008c0eba2%2F0x0.jpg)

On a meta-level, we humans know much more about objects external to us than the biological mechanisms inside us. One sign of civilization is the ability to develop tools and start a fire. Now, most of the technological breakthroughs we have achieved are building bigger, more efficient, and cheaper machines. We have really forgotten to look inwards and 'improve' ourselves instead.

Forbes' video is very sci-fi. It is a fascinating piece of entertainment and reminds us of biological solutions to technological problems. Supercomputer? Build a brain-based supercomputer. Spaceship? Build a living spaceship with engineered organisms that can survive in spcae. Skyscraper? Build a living building that has a self-contained ecological system from its root (the foundation/basement) to its branches (floors) to its top (the rooftop).

For a long time, we have looked for solutions external to us. Now is the time to look inwards.

Philosophically, are bio-organisms inherently more 'programmable' and more 'useful' compared to non-organisms? The arguments for the proposition are hinted at in Forbes' video. On the other hand, we should also bear in mind that while evolution and random genetic mutation is indeed a powerful mechanism to diversify nature's bets, it is a loooooong process.

Scientifically, in order to build a brain-based supercomputer with re-engineered neurons, we need to understand how our own brains work. One milestone is to study brain organoids. My work at Oxbridge Organomics also revolves around organoids. If you are interested in knowing more, message me.

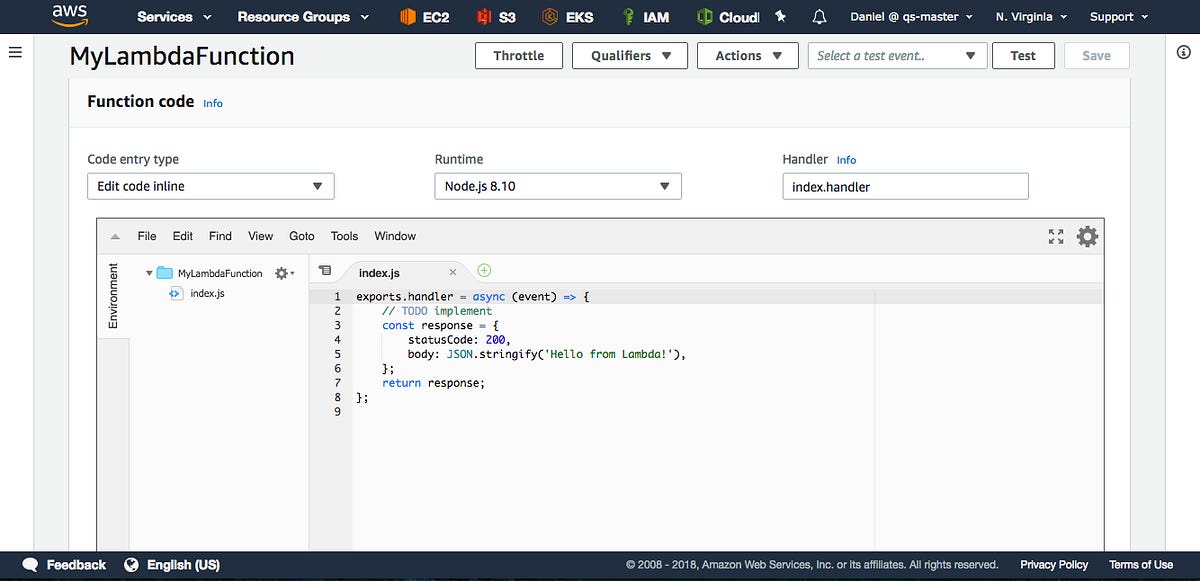

8. The meaninglessness of saying 'serverless'

Justin at Technically does a really good job at dumbing down technical concepts to non-technical folks with a certain level of technical literacy.

His recent piece on serverless is especially interesting given how we have assumed the omnipresence of AWS as a 'serverless' phenonmenon. Justin added a few layers of nuances and distinguished between SaaS, PaaS, functions and database.

Justin mentioned that in order to scale database and APIs, there are a few options:

- Scaling vertically – whatever server you’re running your database on, make it bigger, faster, stronger

- Scaling horizontally – create copies of your server, and let each shoulder a bit of the load

Here's an example of scaling quantum computing horizontally. If we can't reach 1 million qubits, just connect 1 million 1-qubit quantum computers with each other!

9. Second-order effects of climate change

Successful founders are intellectually curious hustlers – a re-occuring theme on my blog. They are also visionaries that see the trillion-dollar problems of the next decade.

Spacejunk is one of them. Climate change has made our atomsphere less dense, making orbital debris re-entry more likely.

Microsoft's buggy Windows gave birth to the billion-dollar industry of anti-virus software. Will SpaceX and Blue Origin give birth to the industry of 'space cleaners'? And how much is the space cleaning industry worth?

10. What mRNA teaches us about meta-science

There's a reason why the success of the mRNA vaccine has attracted much public attention: it is a bloody difficult achievement. Katalin Kariko spent 30+ years investigating messenger RNA, the genetic material that acts as a kind of courier in the human body, transporting recipes from our DNA to the part of the cell that produces proteins.

On top of the bloody difficult science, she also faced bloody difficult grant-making institutions and an unsupportive academic community. Her experience has led to a movement of New Science, sprung up by scientists and rationalists in the Silicon Valley community. There is much more discussion on meta-science as well: what kind of institutions/structure best promote innovation? Much hate is given to the current Principal Investigator (PI)-driven model. But what is the solution?

Joke of the week

Does technology make us more rational, or more superstitious?

I can personally vouch that technology has only made us more superstitious. My sister knows a lot about Purple Star Astrology, a fairly popular branch of astrology in China. And there are apps that conveniently shows you that at your time and date of birth, what the stars are and where they are.

To be honest with you, it is fairly accurate about my personality, fate (thus far) and even my family's relationship. Want to know more? Message me!

Cool video

Being a fighter jet pilot is my childhood dream. Enjoy this video as you experience 7G force as the pilot played with several near-superhuman tricks in air.

Peace out and have an amazing week ahead.

Do you find these interesting? Sign up here to subscribe. You will also receive a weekly update of this newsletter alongside occasional blog updates.