Future of Stablecoins

Stablecoins is an Internet-native money liability. What is its future?

Stablecoins is an Internet-native money liability.

- It is the new Banking as a Service.

- The Form of stablecoin (Assets) will not change.

- And we are just scratching the surface of its Utility.

Some mental models to predict the future of stablecoins ⬇️

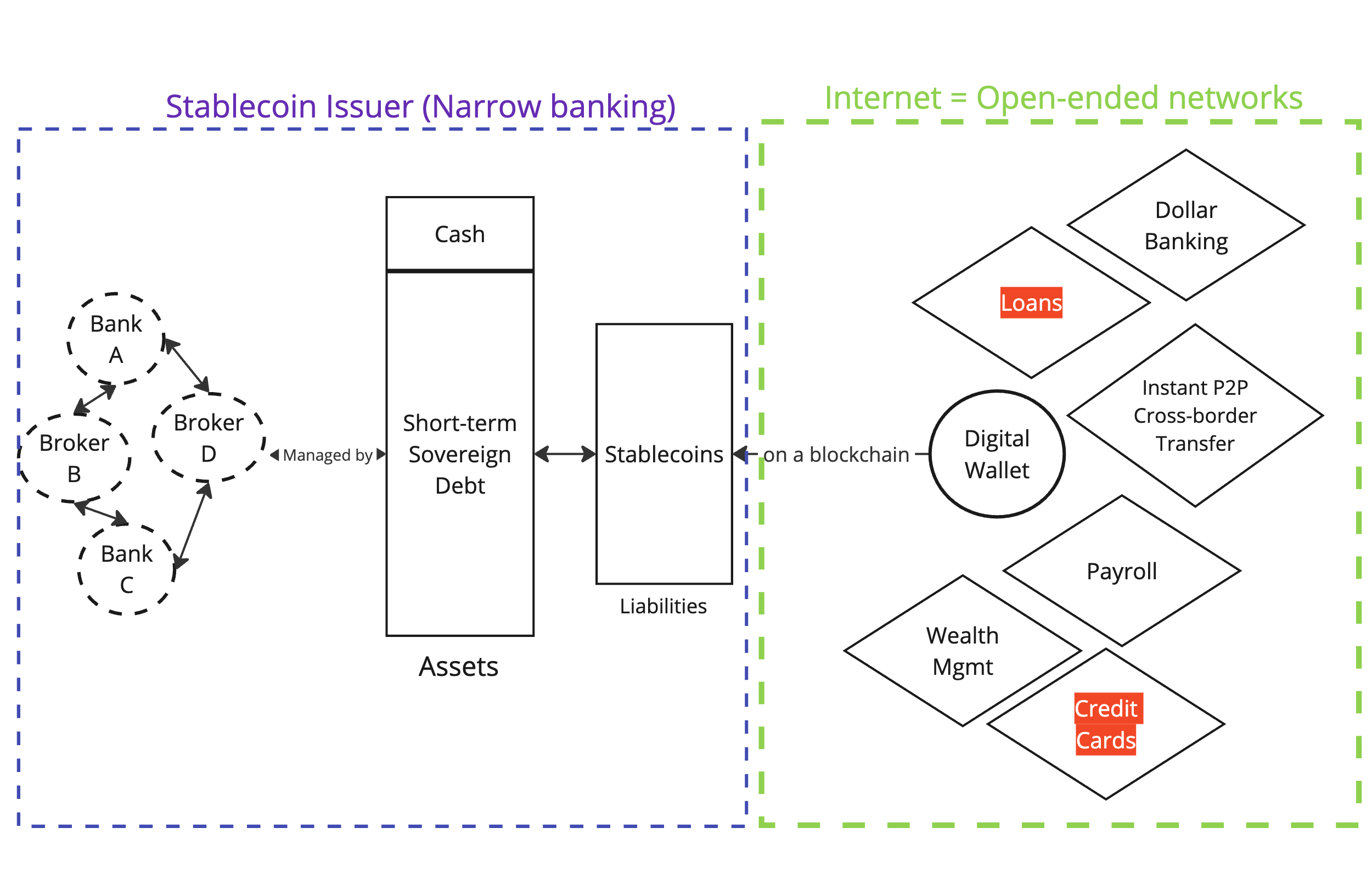

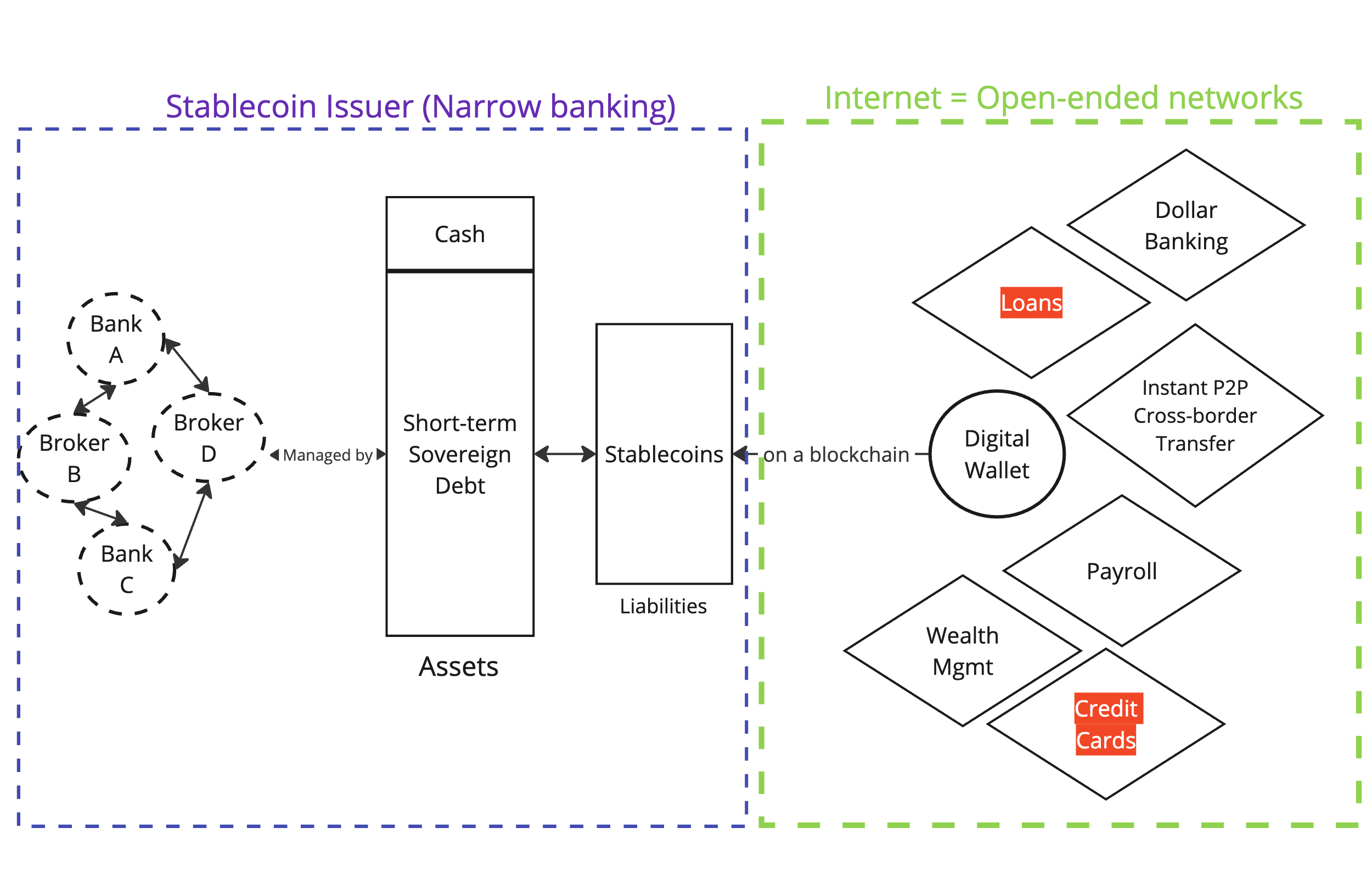

1) Stablecoin is the new Banking as a Service (BaaS)

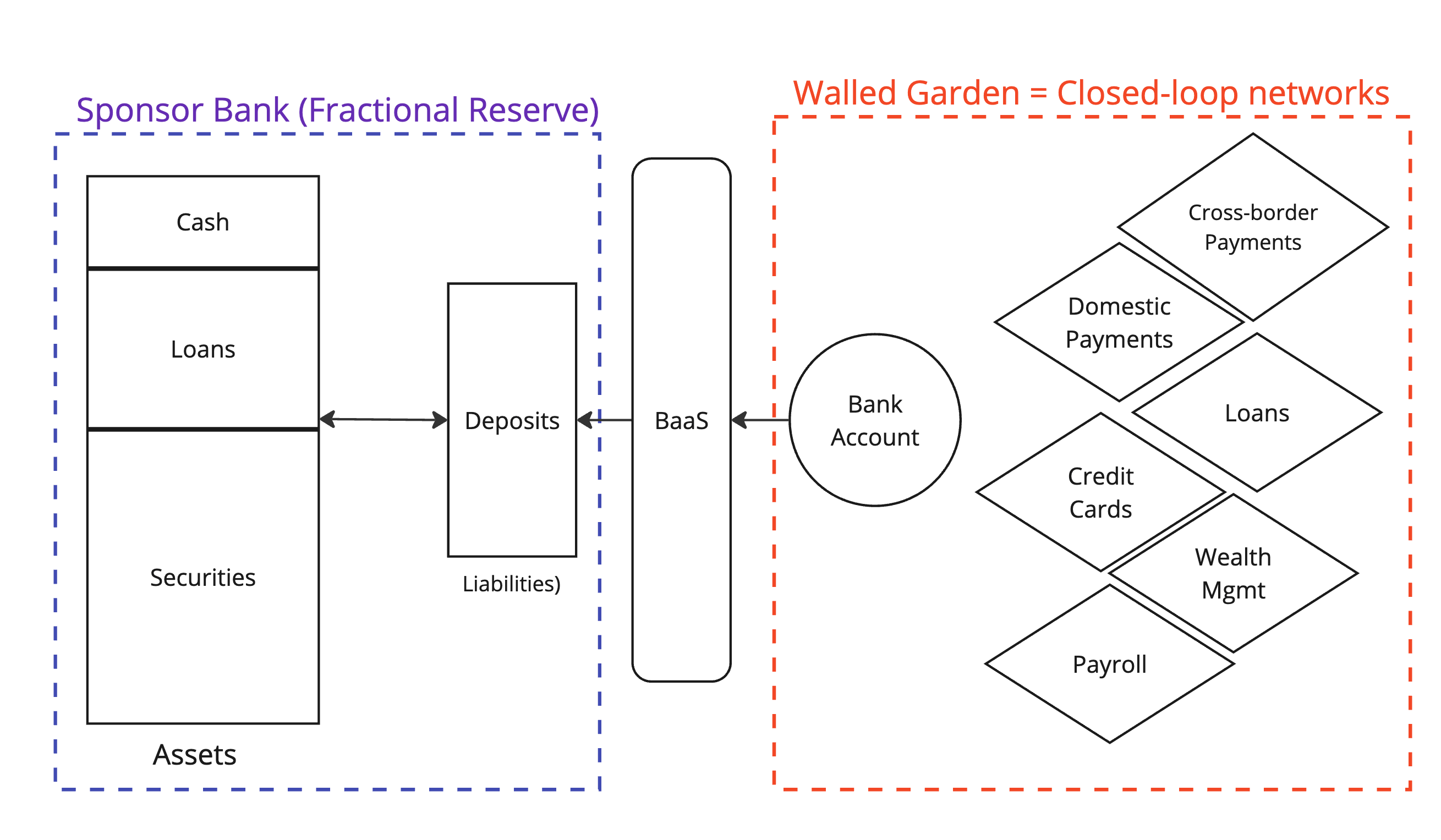

In Web2 fintech, a wave of startups offer Banking as a Service (BaaS) for new applications to be built on top. These BaaS companies are middleware, abstracting away the complexity of interacting with an actual legacy bank.

Companies e.g. Venmo, Wise, CashApp, Affirm etc. all benefit from BaaS and offer new types of products e.g. new types of P2P payments, BNPL, cross-border payments etc.

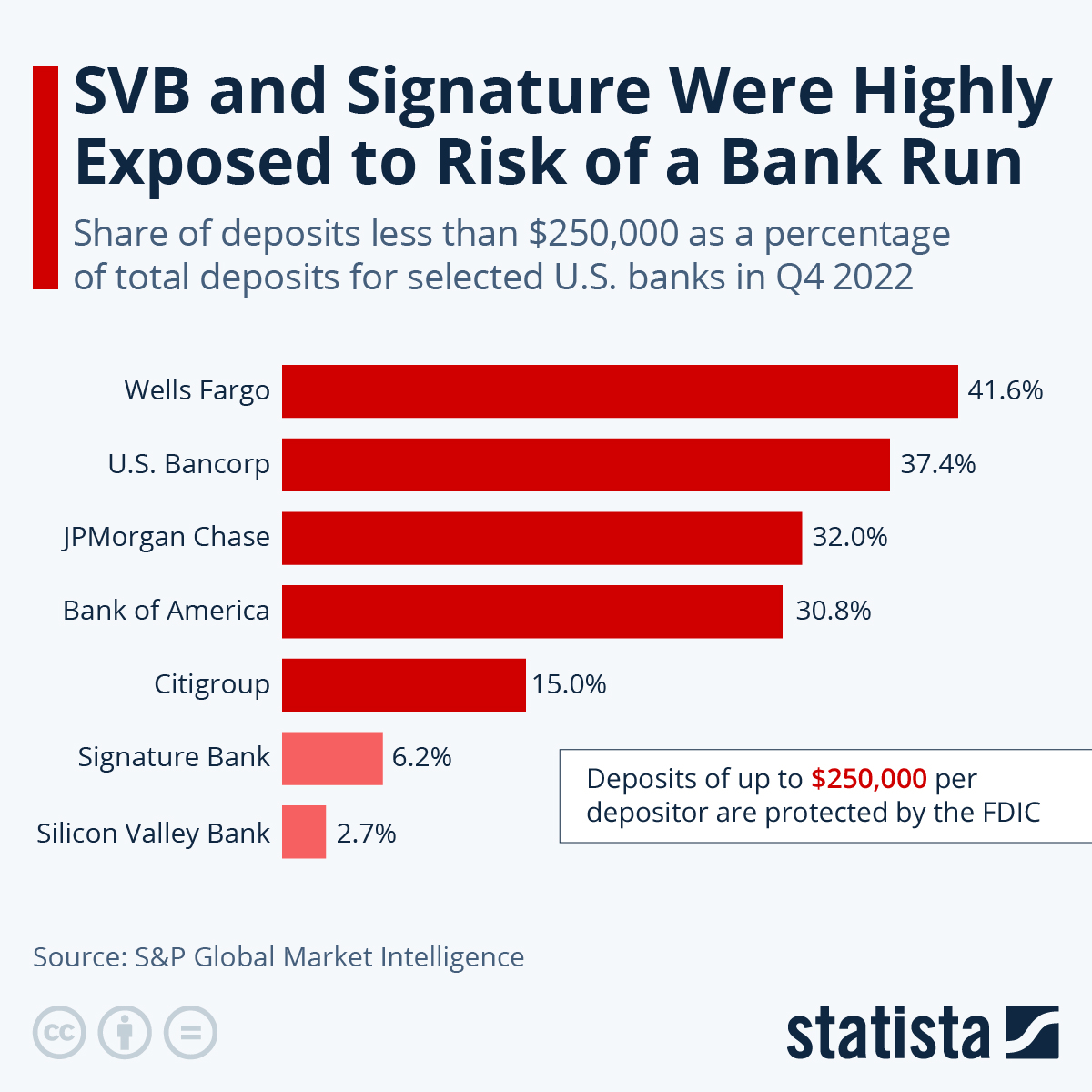

As account holders deposit their money in a fractional reserve bank, they are taking the risk that the banks will not collapse.

And the Silicon Valley Bank collapse has taught us that nothing is certain.

Unfortunately, one of the leaders in BaaS middleware, Synapse, has gone bankrupt, causing massive headaches for its clients and partners.

And one of the leading sponsor banks, Evolve Bank, has also suffered from a massive data breach since it was hacked by Russian hackers.

Nevertheless, what could be an alternative to Banking as a Service?

If BaaS unleashed Fintech 2.0, then stablecoin is empowering Fintech 3.0

Fiat-backed Stablecoins (e.g. Circle , Tether , Paxos) are the future of BaaS. They represent on-chain claims in the form of tokens on some fiat collateral held somewhere off-chain.

On the Assets side, issuers do NOT give out loans. They are narrow banks.

On the Liabilities side, they are now distributed as 'tokens', on the blockchain. Now, anyone with Internet access and digital wallets purchase stablecoins and hold these Liabilities.

Once we adopt this mental model, it is pretty clear to me that functionally, stablecoin is offering the same service to consumers as BaaS.

Holding $USDC as a non-US user == having a USD account via Wise.

![Wise Multi-Currency Account Review [2024]: All you need to know - Exiap](https://www.exiap.com/wp-content/uploads/2023/06/wise-account-card-and-app-1-1024x685.jpg)

Of course, even though the two are equivalent functionally as consumers, they are different structurally.

If you are a consumer holding $USDC, you face the risk of Circle as an issuer, BlackRock as the securities broker, and Circle's banking partners; If you have a USD account via Wise, you face the risk of Wise's BaaS partner and the underlying sponsor bank, which is run by their fractional reserve.

So why have stablecoins hit such growth over such a short period of time?

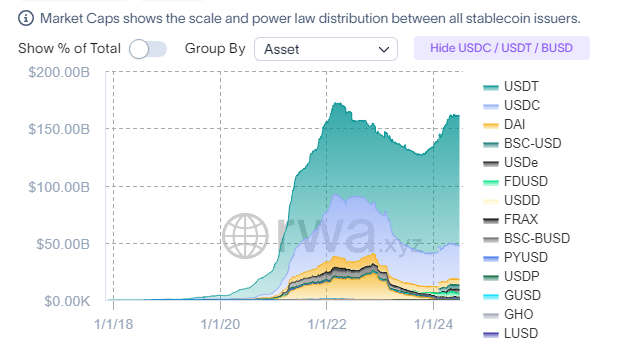

It is now over $200B+ of supply in circulation and has become the 18th largest holder of US Debt.

It is all because how liabilities (deposits in web2 vs stablecoins in web3) are distributed.

In web2, deposits are trapped in closed-loop networks (e.g. domestic payments network, SWIFT)

In web3, stablecoins are Day 0 ledgered on public blockchains. They are open-ended networks.

It also explains why public blockchains are likely to achieve Lindy effects because they are the Shelling point for all market participants to coordinate.

just like @nic__carter said, but to add:

— Jack Chong (@jackchong_jc) July 1, 2024

- public blockchains are general-purpose & shelling point

- ecosystems/service providers have already put sunk cost to integrate (e.g. on/off ramps, custodians, wallets, data providers etc.)

its just the way the market has evolved...

Public blockchains are useful NOT JUST because they are 'public' and 'permissionless'. No one cares about decentralization. What the market cares, however, is that public blockchains are neutral and serves as a coordination point.

Think about this in web2: if JP Morgan would like others to accept its digitalized deposits stored as bits somewhere at their data centers, they have to convince the whole market one-by-one. And other companies have to study JP Morgan's tech stack.

In web3, just deploy on-chain and everyone will follow the same tech stack of the underlying blockchain.

It brings me to my next point:

2️) The Form of Stablecoins (= the Assets side) won't change in the future

Sticky stablecoins have to focus on distribution. They need to increase their liabilities.

To do so, they need to convey trust and reliability. The best way to show that your stablecoin is trustworthy is to make it as risk-free as possible.

Hence, all issuers will naturally converge toward the same composition of assets i.e. Highly Liquid Sovereign Debt and Cash

On regulation

Regulators (US, EU, HK, etc.) are narrowly focusing stablecoin regulations on the assets side. It is easy to mandate what types of assets & how to manage assets. Regulating Assets also makes sense if you want to protect consumers (see Terra/Luna for algo-backed)

While the Form of Stablecoin won't change much,

3️) The Utility of Stablecoins (how liabilities are used) is massively underexplored

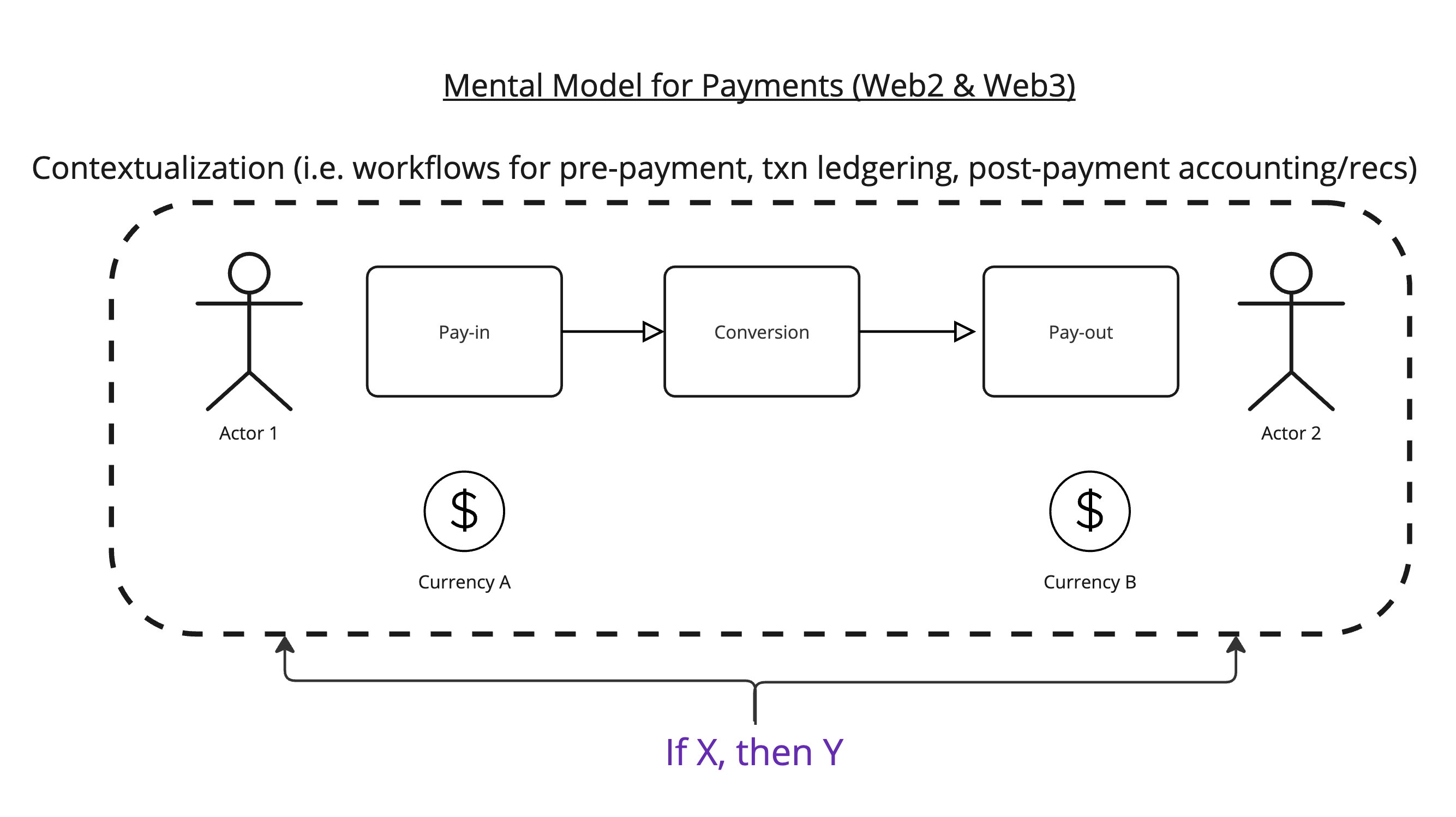

Think about this: payments are fundamentally about sending $x from one place to $y to another place, subject to some conditions.

Here's my mental model. Payment takes 3 steps:

1. Pay-in

2. Conversion

3. Pay-out

Surrounding this workflow you need contextualization

e.g. what is this payment for? Once txn is done, you need to ledger this. Once you receive this txn, you need to combine this with the invoice

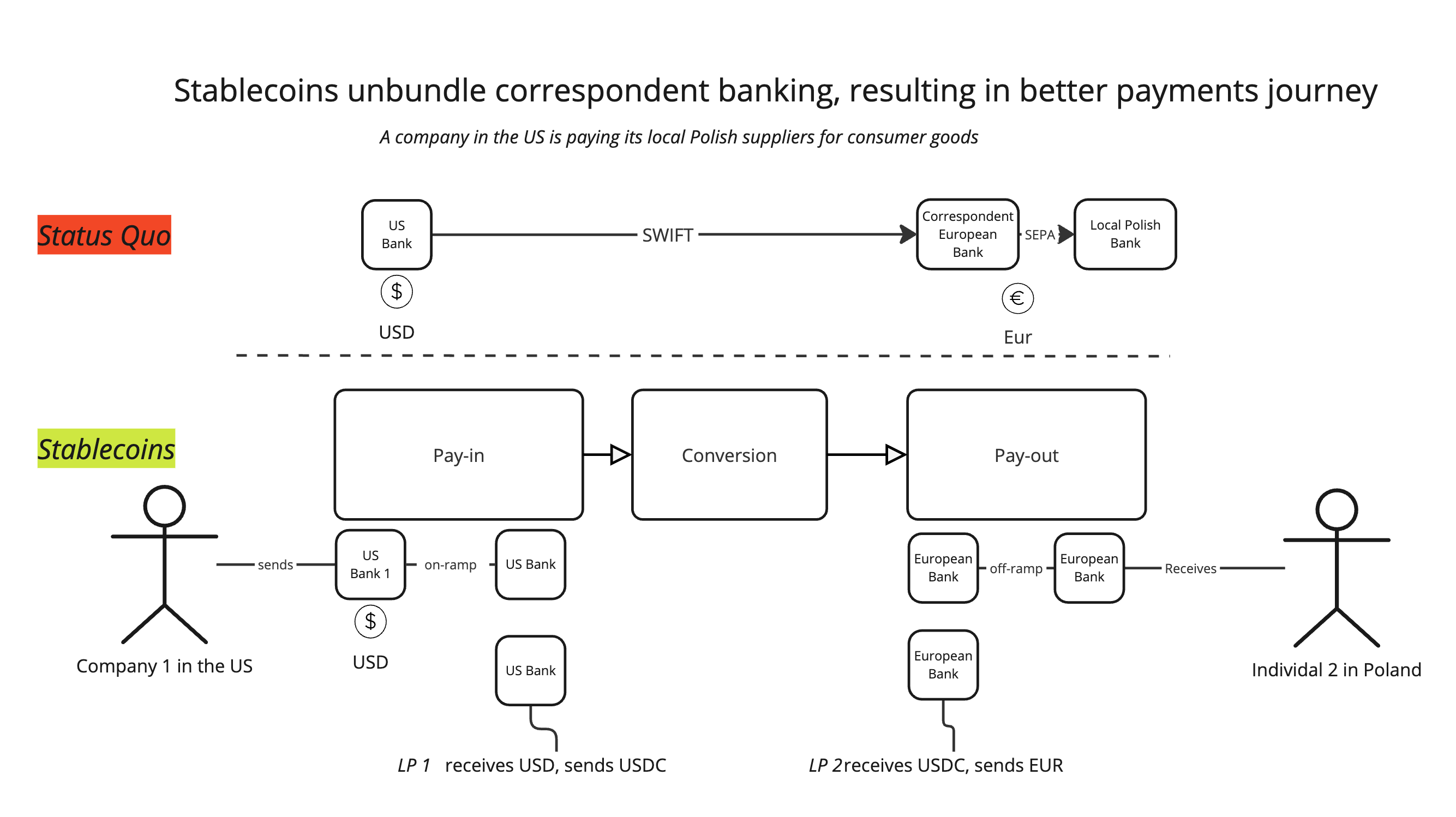

There is a very clear utility of stablecoins right now: unbundling the correspondent banking network with a new set of providers.

Rather than relying on a single SWIFT txn, you now break it down into

< On-ramp -> BaaS -> conversion by LPs -> BaaS -> off-ramp>

You now combine best-in-class in each leg to give a better user journey.

If you're interested, I'd recommend listening to this podcast

But are cross-border payments the only Utility of stablecoins?

I disagree.

There's still a massive whitespace to build LOGICS around programmable money: If X, then Y. Apply it to the whole payments workflow

What about machines that transfer value with each other?

I think that we haven't explored all the funky uses of $USDC @circle

— Jack Chong (@jackchong_jc) August 30, 2023

you can build some time-, no. of parties-, location, and really arb logic with cash transfer @circle you should run a hackathon for creative apps

How would a company like Sentient_agi enable data sources of LLM to be monetized each time an inference is called?

If you spend $10bb to train a model, you can’t give it away for free. Our investment in Sentient aims to change this dynamic. They’re trying to create cryptography embedded within lIms, so if you don't pay the model you can't use it. They call this “model loyalty.”

— Joey Krug (@joeykrug) July 2, 2024

On regulation

How would regulators view the utility of stablecoins? IMO, the only thing that matters is KYC

Jokes aside - I reduce the fundamental tension of stablecoin regulations to one question:

— Jack Chong (@jackchong_jc) May 8, 2024

Can we allow stablecoins to not KYC every single holder?

The STRONGEST regulatory tension I have seen is that

1/ If stablecoins are indeed like BaaS, should regulators regulate stablecoins the same as BaaS, given their functional equivalence?

VERSUS

2/ Should stablecoins be 'cash-like' and allow for anonymity, hence allowing the whole world to continue buying US Treasuries, funding the deficit?

If 1/ happens, the whole stablecoin industry will just crumble.

Market cap will half, volume will half.. Then the US loses a substantial source of UST demand.

- Stablecoins perpetuate use of the US dollar globally, especially in the digital era

— Fred Ehrsam (@FEhrsam) May 14, 2024

- Stablecoin reserves are largely held in US Treasuries and are becoming a meaningful source of demand for US debt

2/ is likely, but I expect heavy pushback from incumbents & offshore banks that benefit from the status quo.

If stablecoins become a much useful form of greenbacks (that is anonymous, similar to physical cash),

why even bother with Swiss banks?

If the US wants its deficit to be funded globally, it should keep stablecoins permissionless

— Jack Chong (@jackchong_jc) May 8, 2024

But... who is going to push back?